Workers’

Compensation Coverage

Enhancing Workplace Safety and Compliance

We understand the complexities of the trucking industry and the vital role your employees play in its success. Our comprehensive workers’ compensation program is designed to meet your unique needs and is overseen by our dedicated claims management team, who have a deep understanding of the nuances of trucking operations and its workforce. Backed by Crum & Forster’s nationwide network of adjusters, we provide a holistic approach to managing your risk and helping injured employees recover and return to work as quickly and safely as possible, while minimizing disruptions to your business.

Workers’ Compensation Coverage

Enhancing Workplace Safety and Compliance

We understand the complexities of the trucking industry and the vital role your employees play in its success. Our comprehensive workers’ compensation program is designed to meet your unique needs and is overseen by our dedicated claims management team, who have a deep understanding of the nuances of trucking operations and its workforce. Backed by Crum & Forster’s nationwide network of adjusters, we provide a holistic approach to managing your risk and helping injured employees recover and return to work as quickly and safely as possible, while minimizing disruptions to your business.

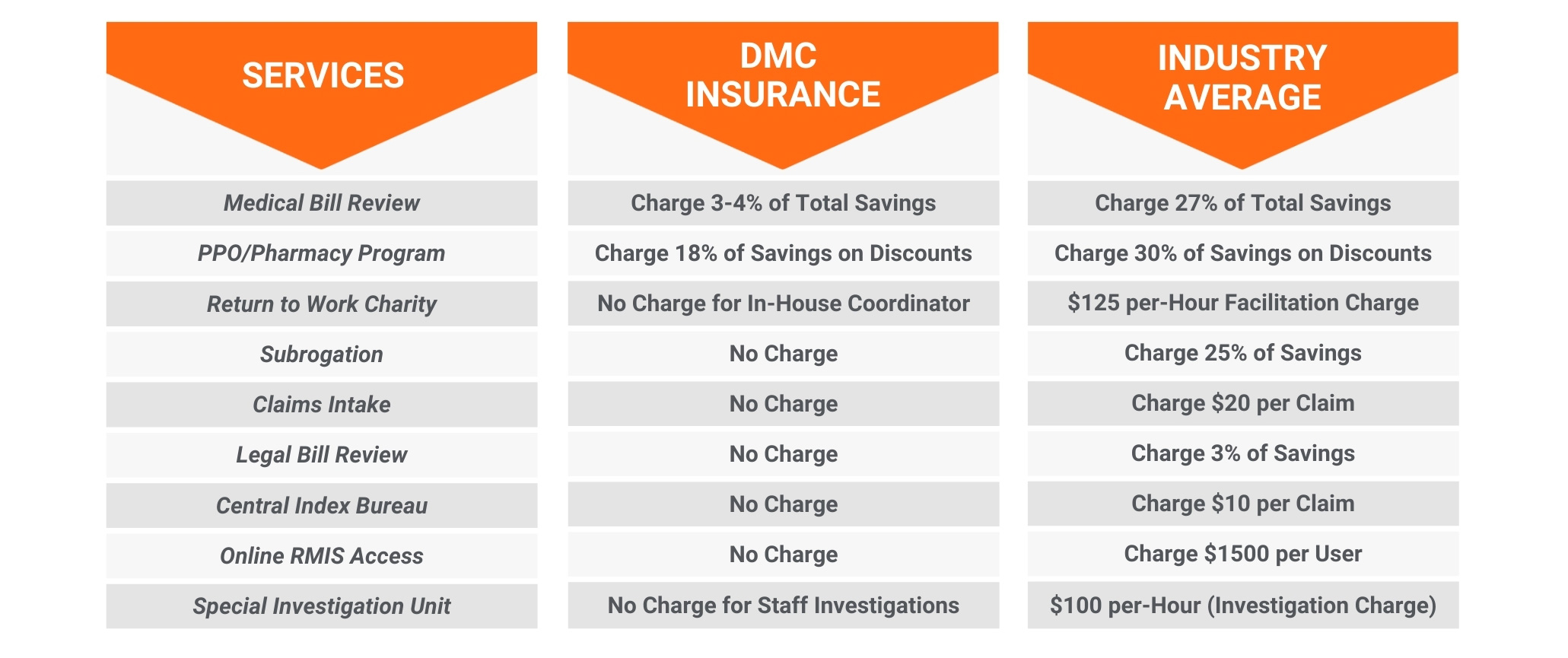

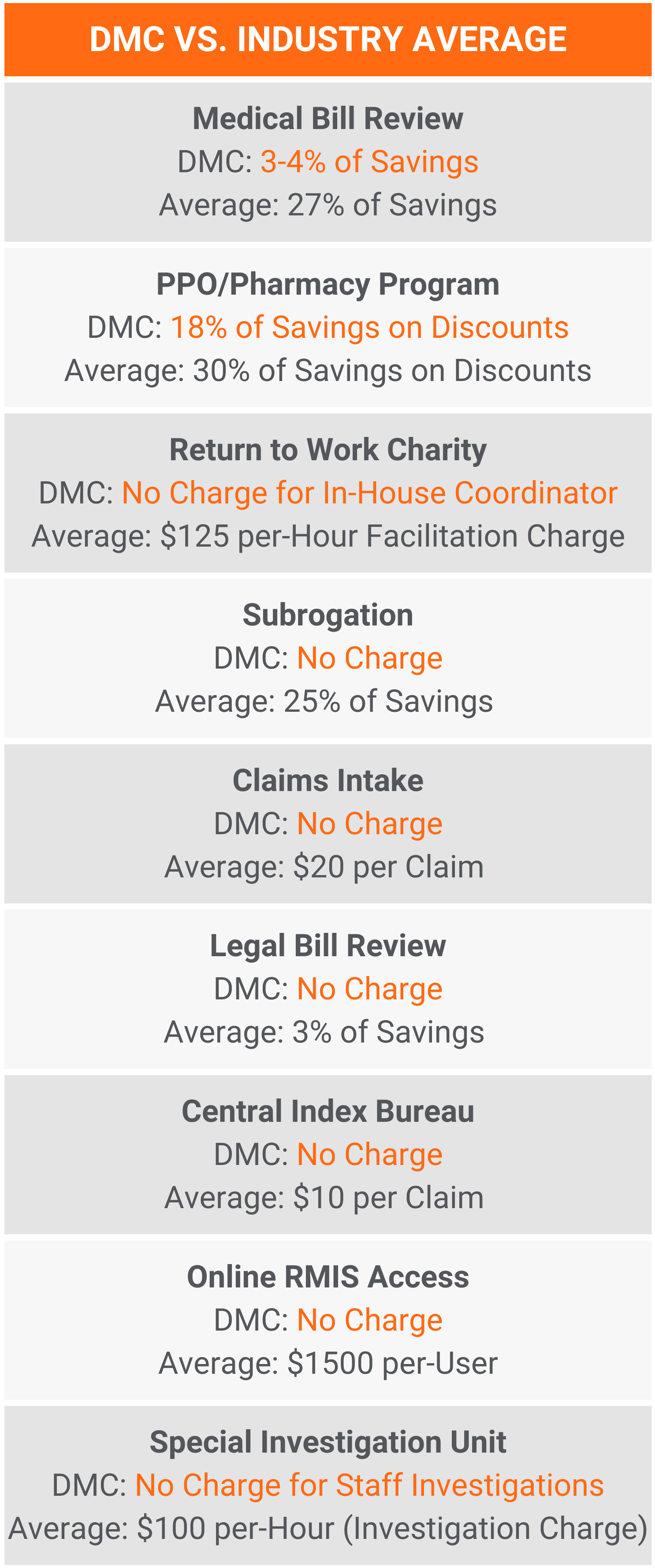

Our Competitive Edge That Protects Your Business

- Regular consultation services provided by a dedicated DMC Risk Engineer to enhance workplace safety and compliance.

- A dedicated Special Investigation Unit to investigate suspicious or non-meritorious claims.

- Dedicated subrogation team that relentlessly pursues recovery.

- Detailed claims reviews.

- In-house physicians to assist with assessing complex medical cases.

- Nurse triage program available to guide claimants through appropriate treatment options.

- Medicare compliance services with Medicare eligibility verifications offered at no charge.

- Unique Return to Work program, offering temporary assignments at charitable organizations.

- A comprehensive network of approved defense firms with transportation specialty practices.

- Proactive case resolution, but fully prepared to defend cases when needed.

Confidence in Every Claim: Hear from Our Customers

Pursuit of the Truth

Discover how our Special Investigation Unit saved a workers’ compensation customer hundreds of thousands of dollars by uncovering a fraudulent claim, effectively countering an employee’s demand for unwarranted benefits.

Read the full story to learn how our proactive approach can protect your business.

Pursuit of the Truth

Discover how our Special Investigation Unit saved a workers’ compensation customer hundreds of thousands of dollars by uncovering a fraudulent claim, effectively countering an employee’s demand for unwarranted benefits.

Read the full story to learn how our proactive approach can protect your business.

Pursuit of the Truth

One of our insured’s employees had filed for worker’s compensation and received disability benefits for injuries he incurred. However, both our team and the insured suspected that the claimant was misrepresenting his condition after a lengthy review of the case.

Our SIU division began a thorough investigation including social media searches and surveillance, which uncovered evidence that the claimant was not truthful about his current state. In fact, he was working elsewhere, actively engaged, and traveling internationally while collecting disability payments. The claimant hired an attorney to seek further damages, demanding $350,000. Despite this development, DMC and the insured refused to settle and decided to move forward with a hearing armed with the compelling evidence collected and testimonials from the DMC SIU team and other professional investigators.

As a result, the claimant was permanently denied future wage loss benefits, and the state authorities are now investigating the case for fraud prosecution. Thanks to the SIU’s efforts, DMC and the insured were not obligated to pay the claimant’s demand and are seeking reimbursement for any expenses that were paid out.